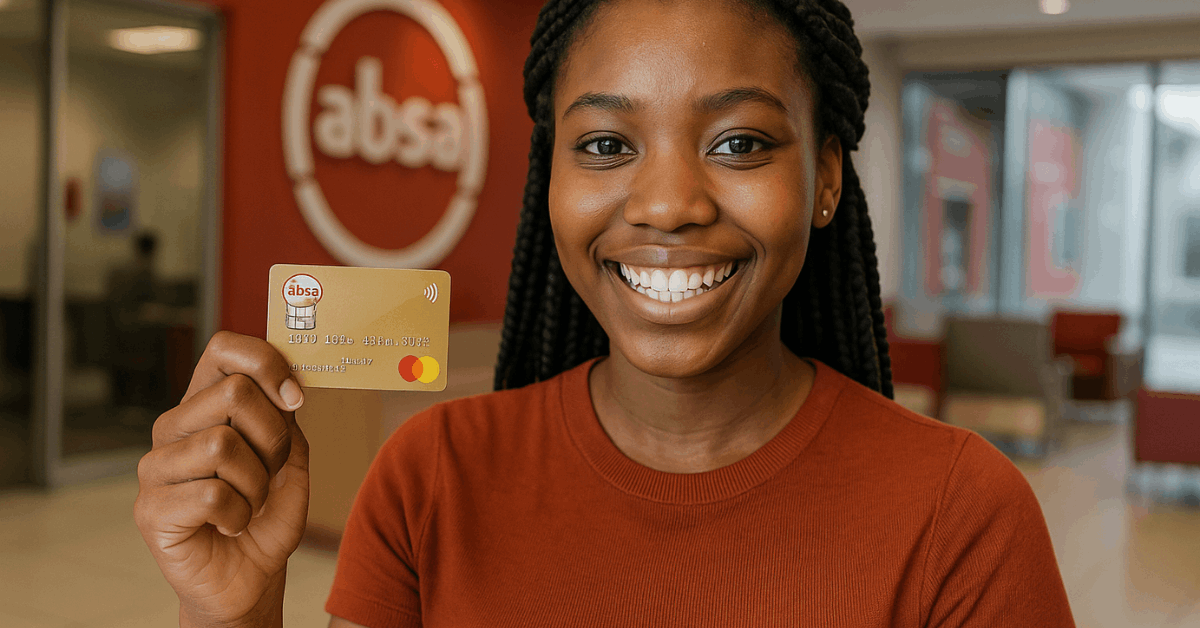

The Absa Credit Card gives you rewards, convenience, and secure spending in one. It helps you manage purchases while earning cash back and travel perks.

With global access and flexible payments, it fits users earning about R7 000 per month. This card combines daily use with valuable lifestyle benefits.

Understanding the Gold Credit Card

The Gold Credit Card helps you simplify payments while enjoying access to both online and in-store transactions.

It is a reliable option for those seeking long-term credit growth and lifestyle flexibility. This card connects you to the Visa network, enabling seamless payments worldwide.

You also benefit from automatic travel insurance and protection against loss or theft, making it ideal for both convenience and safety.

Key Features and Monthly Details

The Gold Credit Card has features that make it convenient for regular use. It is structured to balance affordability and lifestyle value.

- Monthly fee: R64, ensuring cost-effective access to premium benefits

- Recommended income: R7 000 per month to qualify

- Automatic insurance: Coverage up to R1.5 million for travel emergencies

- Contactless payments: Secure transactions up to R500 without PIN

- Card type: Visa, accepted globally

These features make it suitable for users who want a balance between rewards and control over their monthly budget.

Cash Back and Lifestyle Rewards

Earning rewards for your daily purchases is one of the strongest attractions of the Gold Credit Card.

It turns your spending into value by returning a portion of your money through structured programs. With Absa Rewards, you get cash back every time you make qualifying payments.

You can also unlock Absa Advantage benefits through the banking app by completing simple challenges that often come with free meals or discounts.

Reward Programs You Can Access

The Gold Credit Card supports several reward options that enhance your daily routine. These programs encourage engagement through the app and spending in select partner stores.

- Absa Rewards: Earn cash back on eligible card purchases.

- Absa Advantage: Win lifestyle perks for completing challenges.

- Visa Global Offers: Access merchant discounts and travel promotions.

- Buyers Protection: Shop confidently with extended coverage on purchases.

Each program allows you to experience personalized benefits and enjoy more value from your monthly transactions.

Travel Benefits and Global Access

For frequent travellers, this card offers practical support both locally and abroad. You can save money through discounted airport lounges and built-in travel insurance.

The Bidvest Premier Lounge access gives you preferential rates at both domestic and international airports.

You also enjoy automatic basic cover when booking international trips, providing peace of mind during emergencies.

International Perks That Add Value

The Gold Credit Card integrates travel support features for convenience. These are especially beneficial for users who frequently visit airports or book overseas flights.

- Lounge access: Entry to Bidvest Premier Domestic and International lounges.

- Automatic travel cover: Up to R1.5 million for emergencies abroad.

- Visa worldwide access: Pay or withdraw cash in multiple currencies.

- Accepted globally: Reliable for both travel and online shopping.

These benefits ensure that every trip is more comfortable, secure, and rewarding.

Smart Payment and Security Features

Your Gold Credit Card gives you flexibility when making payments through multiple digital methods.

You can pay via smartphone, smartwatch, or physical card while maintaining strong security.

It also offers instant alerts and protection for lost or stolen cards. Each transaction helps build your credit history, allowing you to improve financial trust over time.

Protection and Monitoring Tools

Security is central to every Absa card service. The following tools are available to safeguard your information and spending.

- NotifyMe: Instant SMS alerts for each card transaction.

- Lost Card Protection: Free service for immediate blocking and replacement.

- Chip and PIN: Encryption ensures secure purchases worldwide.

- Credit History Tracking: Build long-term credibility with consistent use.

These tools make the Gold Credit Card a secure financial companion in both digital and physical payments.

Eligibility and Requirements

Before applying, make sure you meet the minimum qualifications. The Gold Credit Card is designed for employed or self-employed South Africans with consistent income.

It’s important to prepare all necessary documents to avoid processing delays. Meeting eligibility standards ensures smoother approval and faster activation.

Qualification Checklist

Applicants should meet specific requirements to qualify for this card. Below is a summary of what you’ll need.

- Minimum income of R7 000 per month

- South African ID and proof of address

- Recent payslip or three-month bank statement

- Age 18 years or older

- Good credit record with no active defaults

Having these ready helps your application process move faster and increases the likelihood of approval.

How to Apply for the Gold Credit Card?

Applying is straightforward through Absa’s digital or in-branch platforms. You can use either method based on your preference and convenience.

Online applications are fast and paperless, while in-branch visits allow you to get guidance from banking staff. Both channels are secure and efficient.

Online Application Process

You can apply online by visiting the website or opening the Absa Banking App. Follow the steps below to submit your request.

- Choose “Gold Credit Card” from the available credit card list.

- Click “Apply Now” and complete the online form.

- Upload your proof of income and identification.

- Review your details and submit the application.

- Wait for confirmation by SMS or email.

The process usually takes only a few minutes, depending on the accuracy of your information.

Applying at a Branch

If you prefer in-person service, visit the nearest Absa branch during business hours.

Bring your identification and supporting documents for verification.

A financial consultant will assist you with the application form and eligibility review. You may receive preliminary feedback immediately, depending on the documentation provided.

Interest Rates and Fees

Interest rates depend on your credit profile, payment consistency, and income. Absa adjusts these rates according to each customer’s financial behavior.

The Gold Credit Card remains affordable compared to other premium options. Its fixed monthly service fee of R64 covers rewards and insurance benefits.

Typical Rate Breakdown

These are the standard rates and fees for cardholders. They may vary slightly depending on your credit risk profile.

- Interest rate: Between 18% and 22% per annum (variable)

- Cash advance fee: 3% per withdrawal

- Late payment fee: R145 if payment is missed

- Replacement card: R140

- Monthly service fee: R64

These figures are updated periodically, so it’s wise to confirm through Absa’s official channels.

Managing Your Credit Card

Once approved, managing your account responsibly is essential. Absa offers tools that help track spending and control limits.

Through Online Banking and the Absa App, you can adjust credit limits, set alerts, and make secure payments anytime. These digital services simplify your financial routine.

Account Management Tools

These tools are designed to help cardholders maintain oversight and avoid unnecessary fees.

- Online Banking Dashboard: Track balances and upcoming payments.

- Spending Alerts: Monitor usage and reward accumulation.

- AutoPay Setup: Automate minimum payments for convenience.

- Limit Adjustment: Increase or lower your credit limit anytime.

Proper management prevents missed payments and protects your credit score over time.

Customer Support and Contact Information

Absa provides dedicated support for cardholders through multiple communication channels. Assistance is available by phone, online chat, or at any branch.

You can contact the support team for queries, lost card reports, or balance requests. Service lines operate daily for both local and international calls.

Official Contact Channels

Here are the primary ways to reach Absa’s support department for card inquiries.

- Customer Care Line: 0800 111 155 (toll-free)

- Website

- Branch Services: Available nationwide

- App Support: Live chat on the Absa Banking App

These contact points ensure quick access to help whenever you need assistance.

Tips for Responsible Credit Use

Using your Gold Credit Card wisely helps maintain financial stability. Responsible habits lead to long-term rewards and stronger credit ratings.

Keep track of expenses and pay balances in full whenever possible. Avoid over-utilizing credit limits to prevent high interest accumulation.

Smart Credit Practices

Follow these simple habits to get the best value from your card. They promote responsible management and steady financial growth.

- Always pay at least the minimum due before the deadline.

- Keep your credit utilization under 30% of your limit.

- Use your card mainly for planned purchases.

- Report lost or stolen cards immediately.

- Redeem rewards regularly to maximize benefits.

These steps can help you use credit responsibly and sustain good financial health.

Disclaimer

Information in this article may change without notice. Rates and benefits depend on individual eligibility and approval.

Always verify the latest updates through Absa’s official website or branch before applying. This article serves only for educational purposes and does not constitute financial advice.

Conclusion: Apply Today and Enjoy Real Value

The Gold Credit Card offers an excellent mix of affordability, global access, and lifestyle rewards. It fits working professionals who seek to earn cash back while enjoying travel perks.

With secure payment options, rewards programs, and financial tools, it provides both practicality and prestige.

If you meet the requirements, apply responsibly, and experience a smarter way to manage your money today.